Probate is the process that transfers legal title of property from the estate of the person who has died (the “decedent”) to his or her proper beneficiaries. The term “probate” refers to a “proving” of the existence of a valid Will, or determining who the legal heirs are if there is no Will.

The probate process also provides for the collection of any taxes due by reason of the deceased’s death or on the transfer of his or her property. Additionally, it provides a mechanism for payment of outstanding debts owed by the decedent.

The probate process also provides for the collection of any taxes due by reason of the deceased’s death or on the transfer of his or her property. Additionally, it provides a mechanism for payment of outstanding debts owed by the decedent.

Who is responsible for handling the probate process?

A “Personal Representative” (sometime also referred to as the “executor” or “executrix” if there is a Will, or the “administrator” or “administratix” if there is no Will) is appointed as part of the probate proceeding. This person has the responsibility for managing the estate through the proceeding, subject to the direction of the court and the probate rules and procedures.

Typically, the probate court has a considerable amount of control over the activities of the Personal Representative. Often the court will require that she or he obtain prior permission before certain actions may take place (e.g., the sale of property) The court will also typically require an accounting from the Personal Representative of all transactions.

Where is probate handled?

Probate usually occurs in the appropriate court in the State and County where the deceased permanently resided at the time of his or her death. Such courts go by different names in various states. In many states the court is simply called the Probate Court.

The probate court usually handles the distribution of all the personal property the deceased owned, as well as all of the real estate that the deceased owned that is located in that same state.

Does all property have to go through probate?

Real and personal property owned as a joint tenants passes to the surviving co-owners without going through probate.

Other types of benefits, such as life insurance or annuities payable directly to a named beneficiary bypass probate. Money from IRAs, Keoghs, and 401(k) accounts transfer automatically, outside probate, to the persons named as beneficiaries. Bank accounts that are set up as payable-on-death account (POD for short) or an “in trust for” account with a named beneficiary also pass to that beneficiary without probate.

If a Living Trust holds legal title to property, that also passes to the beneficiaries without probate. (The Trust is a legal entity which survives you after your death.)

How are estate creditors handled?

As part of the probate process, creditors are notified of the death. They must file a claim for the amounts due. If the claim is approved by the executor, the bill is paid out of the estate. If the claim is rejected, creditors must sue for payment.

If there are insufficient funds to pay debts, states have statutes of one kind or another establishing who gets paid first. Executors most likely will commence selling property to pay off approved creditor claims. Any claims remaining are pro-rated.

How are taxes handled in probate?

For federal and state tax purposes, death triggers two events:

- It ends the decedent’s last tax year for purposes of filing an income tax return, and

- It establishes a new, separate entity for tax purposes, the “estate”.

For Federal tax purposes, it may be necessary to complete and file one or more of the following, depending on the decedent’s income, the size of the estate, and the income of the estate:

- Final Form 1040 Federal Income Tax return.

- Form 1041 Federal Fiduciary Income Tax returns for the estate.

- Form 709 Federal Gift Tax return(s).

- Form 706 Federal Estate Tax return.

For state purposes, an executor must file the appropriate state income tax return plus possible estate tax, inheritance tax and gift tax returns. In many states, gift, estate and inheritance taxes have been eliminated for most small and medium-sized estates. The requirements for filing and payment vary widely from state-to-state.

What if there is no will?

If a person dies without a Will the probate court appoints a Personal Representative frequently called an “Administrator” or “Administratix” to receive all claims against the estate, pay creditors, and then distribute all remaining property in accordance with the intestacy laws of the state.

The major difference between dying testate and dying intestate is that without a valid Will an intestate estate is distributed to beneficiaries in accordance with the distribution plan established by state law; a testate estate is distributed in accordance with the instructions provided by the decedent in his/her Will.

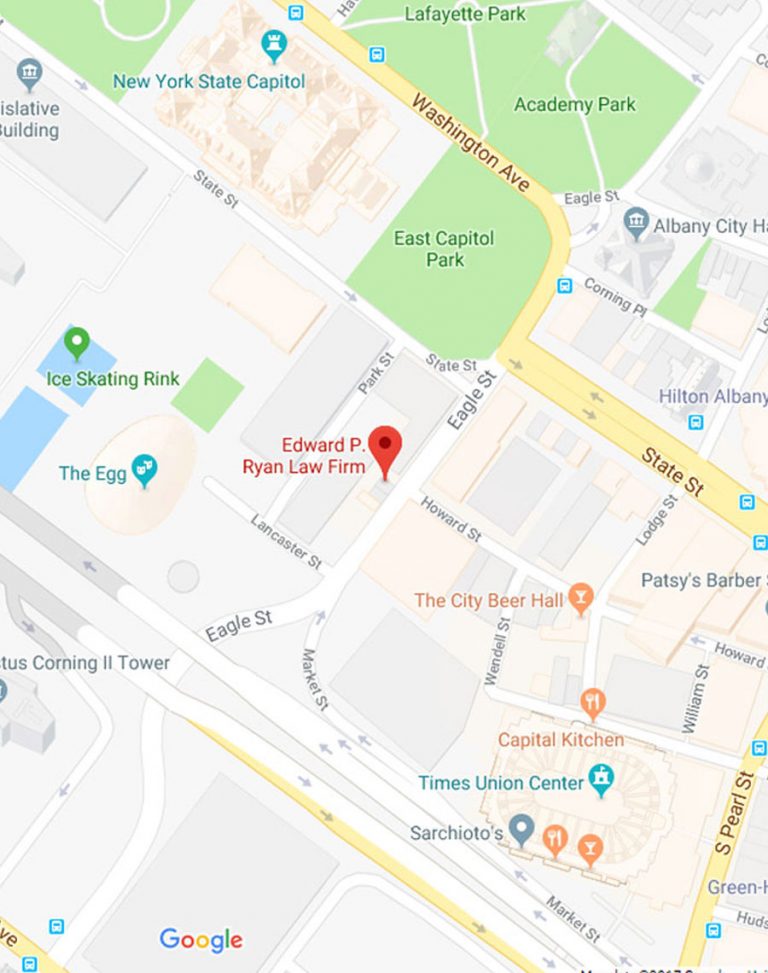

If you need legal assistance with a probate matter, call The Law Office of Ed Ryan at (518) 465-2488 or contact us online.